To download the June 2020 Auto Aggregate PDF, click here.

Fewer cars bought. Fewer miles driven. Less travel. Reduced or eliminated paychecks and massive spikes in unemployment. The problems are legion for the US auto sector. Even with some initial estimates of the difficulties proving to be overstated, credit challenges could remain with the US auto sector for some time.

The UK auto sector, where production has been reduced drastically and jobs are being cut, finds itself in a similar situation.

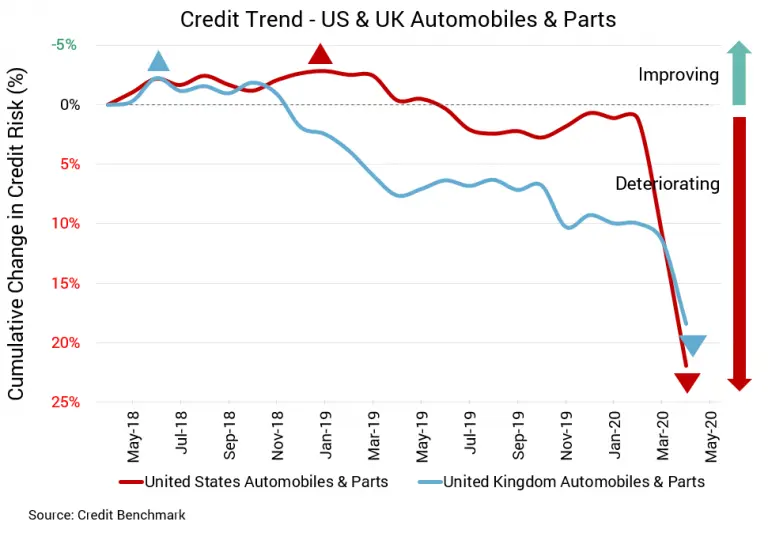

Last Two Months Have Brought Default Risk Increase of More Than 20% for US Auto Companies

- Credit quality for the US-based auto industry has plunged 20.4% in the last two months, far out-pacing decline for UK auto sector.

- Despite the rapid growth in credit risk among US companies, overall credit quality remains worse for UK firms, which have higher overall probability of default.

US Auto and Auto Parts Industry

Credit quality continues to plummet for the US auto sector, deteriorating 10% from the prior month and 20.4% over the last two months, compared to a decline of 22.2% versus the same point last year. The average probability of default for the sector is 43.4 basis points, compared to 39.5 basis points in the prior month, 36 basis points two months prior, and 35.5 basis points at the same point last year. While the Credit Benchmark Consensus (CBC) rating for this sector has remained bbb- over the last 12 months, it is now fewer than 5 basis points away from a downgrade to the high yield bb+ category. More than 80% firms with a rating are at bbb or lower.

UK Auto and Auto Parts Industry

Credit quality is also worsening for the UK auto sector, deteriorating 6% over the last month and 7% over the last two months. Year-over-year, the drop is 9%. Average probability of default for this sector is now 61.6 basis points, compared to 58.1 basis points the prior month, 57.5 basis points two months prior, and 56.3 basis points at the same point last year. The current CBC rating for this sector is bb+, unchanged over the last year, and more than 80% of the firms with a rating are at bbb or lower.

About Credit Benchmark Monthly Auto Industry Aggregate

This monthly index reflects the aggregate credit risk for US and UK firms in the automobile and auto parts sectors. It illustrates the average probability of default for auto firms as well as parts suppliers to achieve a comprehensive view of how sector risk will be impacted by trends in the auto industry. A rising probability of default indicates worsening credit risk; a decreasing probability of default indicates improving credit risk. The Credit Benchmark Consensus (CBC) Rating is a 21-category scale explicitly linked to probability of default estimates sourced from major financial institutions. The letter grades range from aaa to d.